ETF: 3 Easy Ways to Invest in S&P500 as a Malaysian

It may seem overwhelming to invest in US stocks as a new investor. Everyone on the Internet is talking about it being one of the best performing investments in the world. But how can you start?

First off, do your own research!

Do take note that there are many other types of investments besides the S&P 500. The content in this article is not financial advice. I write this article as if I were speaking to my younger self who had no idea what investments are, so do treat it as a form of educational content!

Understanding what S&P 500 is…

It is important to know where your hard-earned cash is going. Investing in the S&P 500 is a popular choice for several reasons:

Diversification: The S&P 500 includes 500 of the largest publicly traded companies in the U.S., covering various sectors like technology, healthcare, finance, and consumer goods. This broad exposure helps reduce risk, as poor performance in one sector can be offset by better performance in another. Check out the list of S&P500 companies here!

Historical Performance: The S&P 500 has historically delivered strong returns over the long term, averaging around 10% annually. While past performance is not a guarantee of future results, it does provide confidence in the index's ability to generate returns over time.

Low Costs: S&P 500 index funds and ETFs generally have low management fees compared to actively managed funds.

Economic Indicator: The S&P 500 is often seen as a barometer of the overall U.S. economy. Investing in it gives you exposure to the economic growth of one of the world’s largest economies.

How I invest in the S&P 500

I personally still use Rakuten Trade and Interactive Brokers to invest in VOO. I use both platforms just in case 1 of my accounts are compromised, I wouldn’t lose all of my investments.

Therefore, you can use more than 1 platform to test them out and see which ones you like.

Here are 3 platforms I would recommend to new Malaysian investors who is interested in investing in S&P 500:

Summary

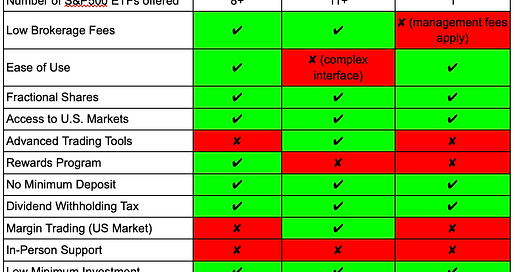

In case you’re a little impatient to read through the whole article, let me summarize the pros and cons of each platform:

Rakuten Trade

What is Rakuten Trade?

Rakuten Trade is an online stock trading platform in Malaysia, a joint venture between Malaysia's Kenanga Investment Bank Berhad and Japan's Rakuten Securities, Inc., which is part of the Rakuten Group. The platform was launched in 2017, offering an easy-to-use and accessible way for Malaysians to trade stocks on Bursa Malaysia, the country’s stock exchange.

S&P500 ETFs offered in Rakuten Trade

Vanguard 500 Index Fund (VOO)

SPDR S&P 500 ETF Trust (SPY)

iShares Core S&P 500 ETF (IVV)

SPDR Portfolio S&P 500 ETF (SPLG)

SPDR Portfolio S&P 500 Growth ETF (SPYG)

Vanguard S&P 500 Value Index Fund ETF (VOOV)

iShares S&P 500 Growth ETF (IVW)

iShares S&P 500 Value ETF (IVE)

And more…

Pros and Cons of Rakuten Trade

Interactive Brokers

What is Interactive Brokers?

Interactive Brokers (IBKR) is a well-established online brokerage firm that provides a comprehensive range of services for trading and investing across global markets. Founded in 1978, it is one of the largest and most versatile brokerage firms in the world, known for its advanced trading platform, low-cost structure, and broad market access.

S&P500 ETFs offered in Interactive Brokers

Vanguard 500 Index Fund (VOO)

SPDR S&P 500 ETF Trust (SPY)

iShares Core S&P 500 ETF (IVV)

SPDR Portfolio S&P 500 ETF (SPLG)

SPDR Portfolio S&P 500 Growth ETF (SPYG)

Vanguard S&P 500 Value Index Fund ETF (VOOV)

iShares S&P 500 Growth ETF (IVW)

iShares S&P 500 Value ETF (IVE)

Invesco S&P 500 Equal Weight (RSP)

iShares Core S&P 500 (CSPX)

Invesco S&P 500 Acc (SPXS)

And more…

Pros and Cons of Interactive Brokers

StashAway

What is StashAway?

StashAway is a digital wealth management platform (often referred to as a robo-advisor) that offers investment and financial planning services. It was founded in Singapore in 2016 and has since expanded to several countries, including Malaysia, the UAE, and Hong Kong. The platform provides users with an automated, low-cost, and data-driven way to invest their money.

S&P500 ETFs offered in StashAway

iShares Core S&P 500 ETF (IVV)

Pros and Cons of StashAway

Conclusion

It is very important to do your own research before you start investing in the S&P 500! All 3 platforms have their own pros and cons, but in the end it’s up to you to decide which platform is the most convenient for you.